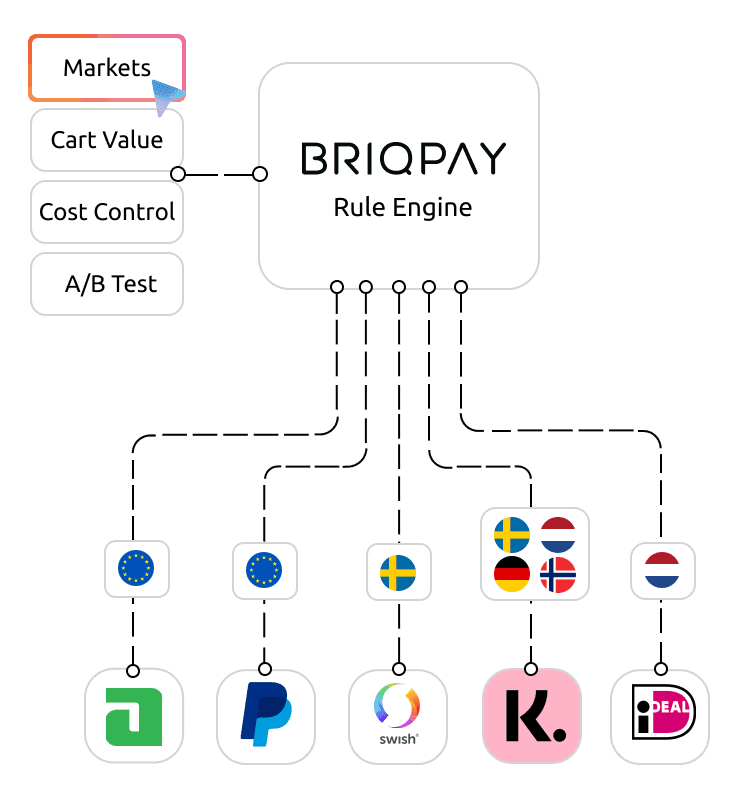

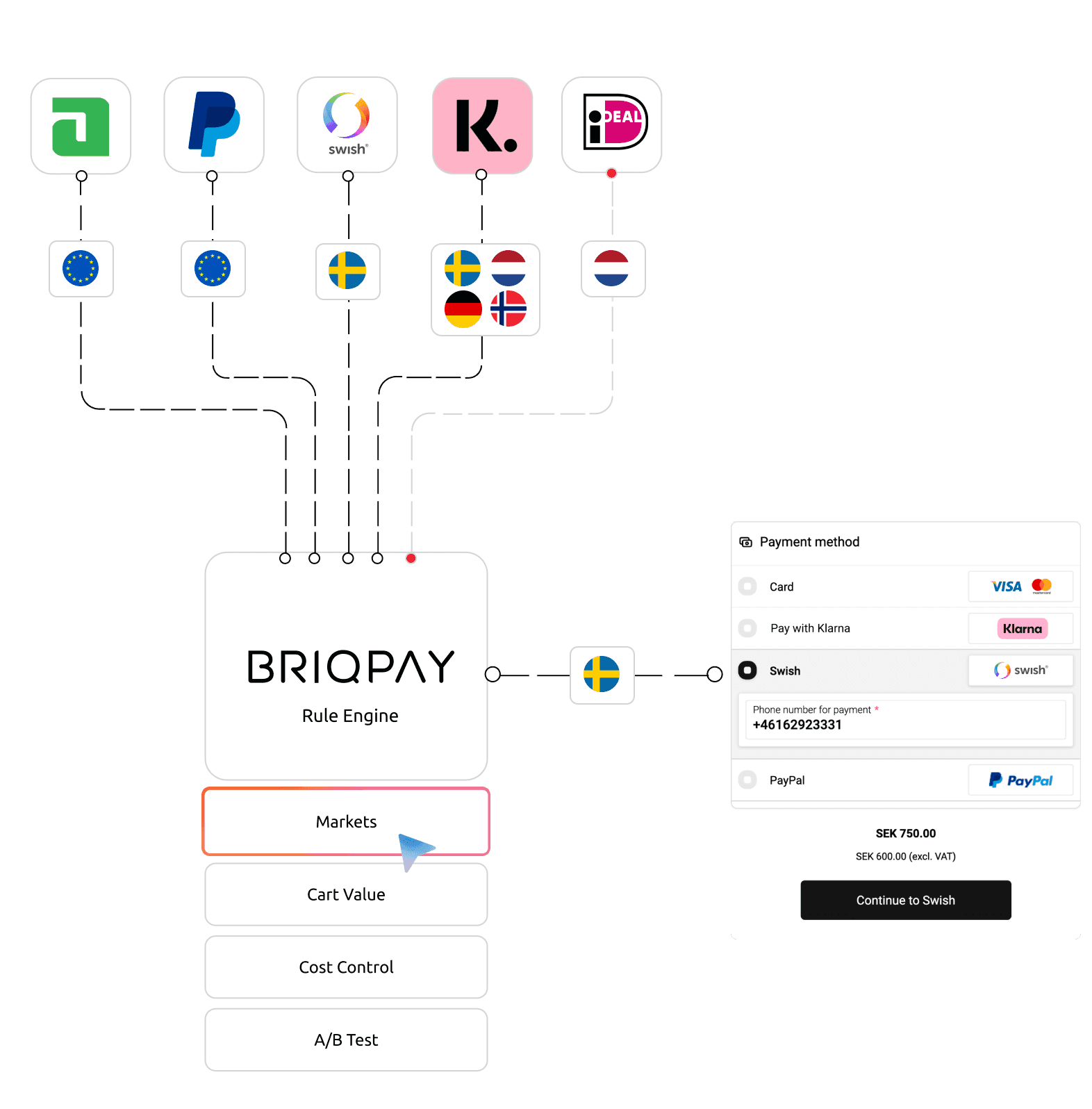

Ensuring the right payment methods are available in each market is crucial for seamless transactions, improved conversion, and in many cases cost optimization. Whether it's through direct agreements or routed through a processor like Adyen, Stripe, we’ve got you covered. We recommend categorizing your payment strategy based on: - Focus markets with direct agreements with local payment providers. - Growth markets with local payment providers through direct agreements or via processors. - Presence markets where you are selling but not actively targeting (e.g., card and PayPal markets). This strategic segmentation ensures that your payment solutions align perfectly with market dynamics, while maximizing efficiency and customer satisfaction.

The optimization platform to transform the world of payments

We specialize in streamlining payment integrations for e-commerce merchants, reducing technical debt, and providing unparalleled flexibility. Our mission is to empower merchants with the tools they need to thrive in an ever-evolving digital landscape.

Simply put – we believe in unleashing your online business’ true potential.

Seamless Integrations

Whether you're a small startup or a large enterprise, our solution seamlessly integrates with your existing systems, ensuring a smooth transition and optimal performance.

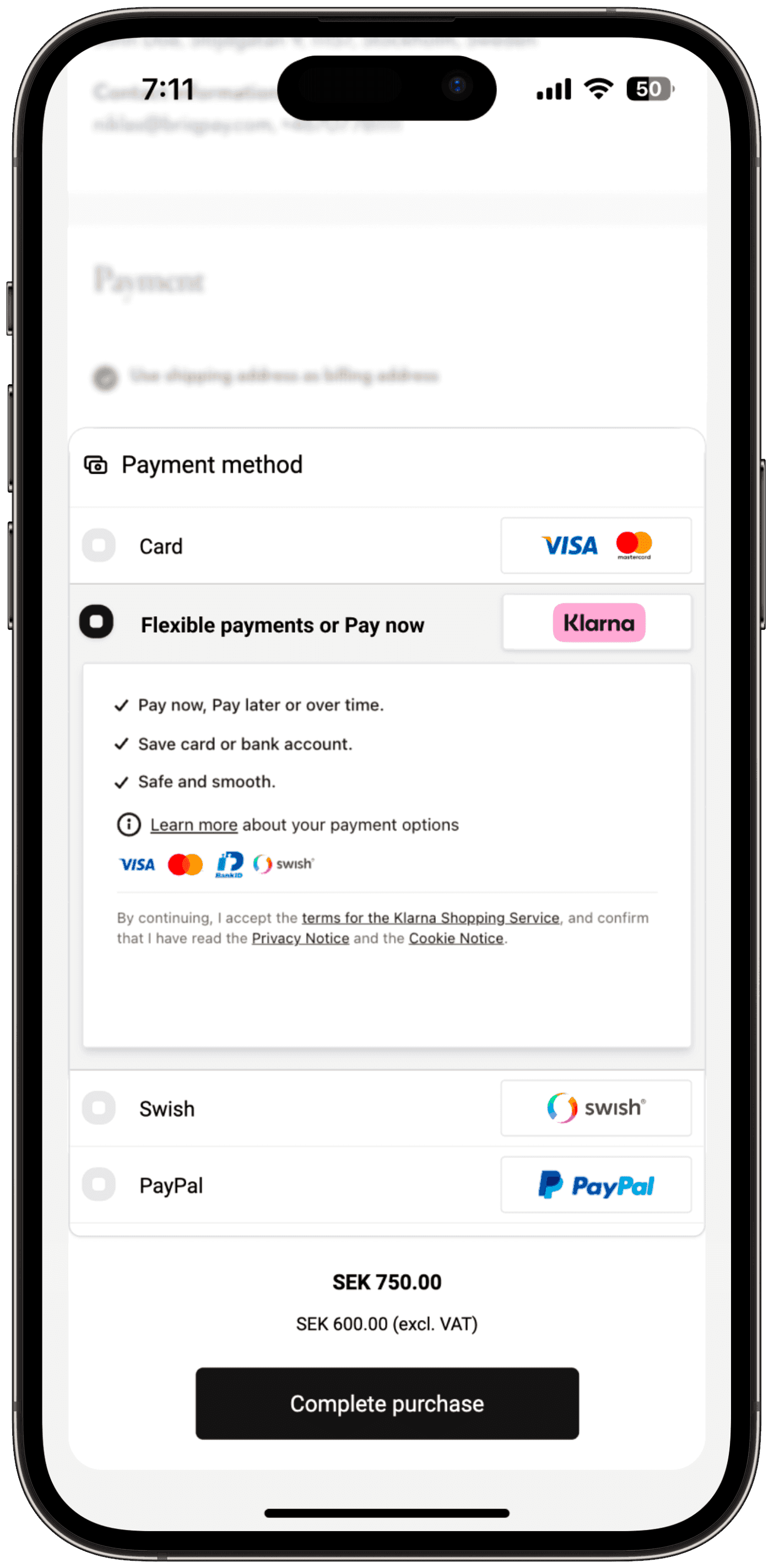

Flexible Payment Options

Enjoy flexibility with seamless access to diverse payment options, avoiding reliance on a single provider. Provide customers with a wide array of choices for their purchases.

Data Is King

Empower your business by retaining ownership of your customers' shopping data. With Briqpay, you control and utilize valuable insights to drive growth and customer satisfaction.

WHY

BRIQPAY

With Briqpay, you’re empowered to improve your payment processes, boost conversion rates, and drive revenue growth.

HOW TO

BRIQPAY

Simplicity is our mantra. With our Payment Optimization Platform, integrations have never been easier. Just one integration is all it takes, and we handle the rest. Say goodbye to the hassle of multiple integrations and technical complexities. Let us guide you on how it works.

1

Choose Your Payment Providers

We understand that you may already have a strategy in mind for the payment options you want to offer in each market, or perhaps you're seeking our expert advice. Whatever your approach, the journey begins with selecting the payment options that align with your business goals. Whether you're looking to expand your reach or optimize your existing setup, we're here to guide you every step of the way. From choosing the right payment methods to navigating the technical aspects, we've got you covered. Let's embark on this journey together.

2

Set Up Providers

Our platform empowers you to maintain complete control over the commercial relationships with payment providers. Whether you have existing agreements in place or are negotiating new ones, we ensure that you're never locked in. With Briqpay, you have the flexibility to adapt and optimize your supplier setup to best suit your business needs without worrying about the complexity of handling several providers.

3

Evaluate Performance

With Briqpay's Insights tool, you can easily measure and evaluate the performance of your payment flows, giving you valuable insights on what can be tweaked for increased performance, whether the goal is to improve conversion, or reduce costs. By setting rules tailored to your specific metrics and goals you can make informed decisions and implement changes that drive higher conversions, and reduce costs, and maximize your business's potential.

IN FULL CONTROL WITH

PAYMENT RULES

Market-Specific Rules

Control of Payment Order

Personalized Buying Experience

Cost Management

Cart-Related Rules

A/B Testing

API-Based Rules

OURPARTNERS